Market demand for similar assets affects their resale price, with higher demand typically leading to a higher salvage value, influencing the asset’s worth at the end of its useful life. The straight-line method is a way to calculate depreciation by evenly spreading the asset’s cost over its useful life. The chosen depreciation method influences the book value of the asset, impacting the gain or loss on disposal. Older assets with shorter remaining useful lives generally have lower salvage values. To estimate salvage value, a company can use the percentage of the original cost method or get an independent appraisal.

FAQ about Calculating Salvage Value

Companies use this value to figure out how much to subtract from the original cost of the thing when calculating its wear and tear. It’s also handy for guessing how much money they might make when they get rid of it. Salvage value can be considered the price a company could get for something when it’s all used up. Sometimes, the thing might be sold as is, but other times, it might be taken apart and the pieces sold.

How does salvage value impact depreciation expense?

Depreciation, on the other hand, is the systematic allocation of the cost of an asset over its useful life. It is a method of recognizing the decline in value and the wear and tear of an asset over time. Depreciation expense is reported on the income statement and reduces the value of the asset on the balance sheet. Imagine you are an employee of a mid-sized company tasked with evaluating the financial viability of a major equipment upgrade.

Everything to Run Your Business

The price you will pay for a lease buyout will be based on the residual value of the car. If you decide to buy your leased car, the price is the residual value plus any fees. Comparing these two values can provide valuable insights into your asset’s true worth and help you make informed decisions.

- This method allows for faster depreciation in the earlier years and slower depreciation in the later years.

- An asset in good condition is likely to have a higher salvage value compared to one that is damaged or in poor condition.

- Technological advances can significantly impact the determination of salvage value.

- You can stop depreciating an asset once you have fully recovered its cost or when you retire it from service, whichever happens first.

- Proper maintenance and regular upkeep can help preserve an asset’s condition and functionality, increasing its salvage value.

Companies can also get an appraisal of the asset by reaching out to an independent, third-party appraiser. This method involves obtaining an independent report of the asset’s value at the end of its useful life. This may also be done by using industry-specific data lottery tax calculator to estimate the asset’s value. This way, the salvage value helps in determining the depreciation; which is an integral part of accounting. As is clear from the definition, the value of equipment or machinery after its useful life is termed the salvage value.

💰 Salvage Value: Calculate It Like a Pro in 7 Easy Steps 💰

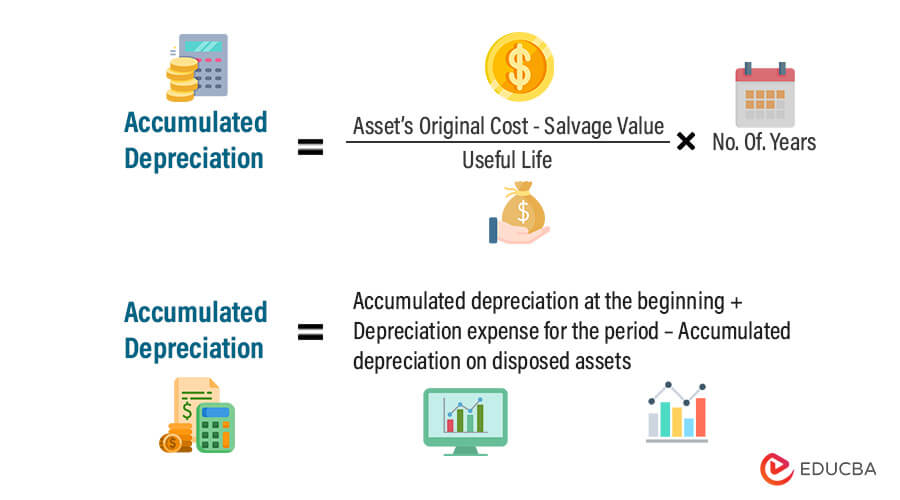

When calculating depreciation, an asset’s salvage value is subtracted from its initial cost to determine total depreciation over the asset’s useful life. From there, accountants have several options to calculate each year’s depreciation. Net cash flows are different from net income because some expenses are non-cash such as depreciation, etc. Residual value is one of the most important aspects of calculating the terms of a lease.

This method allows for faster depreciation in the earlier years and slower depreciation in the later years. Salvage value plays a crucial role in determining the worth of an asset at the end of its useful life. It represents the estimated value of an asset when it is no longer useful or productive to a company. Understanding salvage value is significant as it influences various financial decisions regarding asset management and depreciation. This means that the computer will be used by Company A for 4 years and then sold afterward. The company also estimates that they would be able to sell the computer at a salvage value of $200 at the end of 4 years.

The percentage of cost method multiplies the original cost by the salvage value percentage. A business owner should ignore salvage value when the business itself has a short life expectancy, the asset will last less than one year, or it will have an expected salvage value of zero. If a business estimates that an asset’s salvage value will be minimal at the end of its life, it can depreciate the asset to $0 with no salvage value. Depreciation allows you to recover the cost of an asset by deducting a portion of the cost every year until it is recovered. Depreciable assets are used in the production of goods or services, such as equipment, computers, vehicles, or furniture, and decrease in resellable value over time. Discover how to identify your depreciable assets, calculate their salvage value, choose the most appropriate salvage value accounting method, and handle salvage value changes.

Leave a Reply