If the totals don’t balance, you’ll get an error message alerting you to correct the journal entry. Implementing accounting software can help ensure that each journal entry you post keeps the formula and total debits and credits in balance. The journal entry to increase inventory is a debit to Inventory and a credit to Cash. If a business uses the purchase account, then the entry is to debit the Purchase account and credit Cash. At the end of a period, the Purchase account is zeroed out with the balance moving into Inventory. Increases could also be due to sales returns and in that situation, the journal entry involving inventory is to debit Inventory and credit Cost of Goods Sold.

How to Determine Which is Best for Your Business

That concludes the journal entries for the basic transfer of inventory into the manufacturing process and out to the customer as a sale. There are also two special situations that arise periodically, which are adjustments for obsolete inventory and for the lower of cost or market rule. Spending cash, selling inventory, or customers paying down their debts are all examples of credits since these resources are leaving your company.

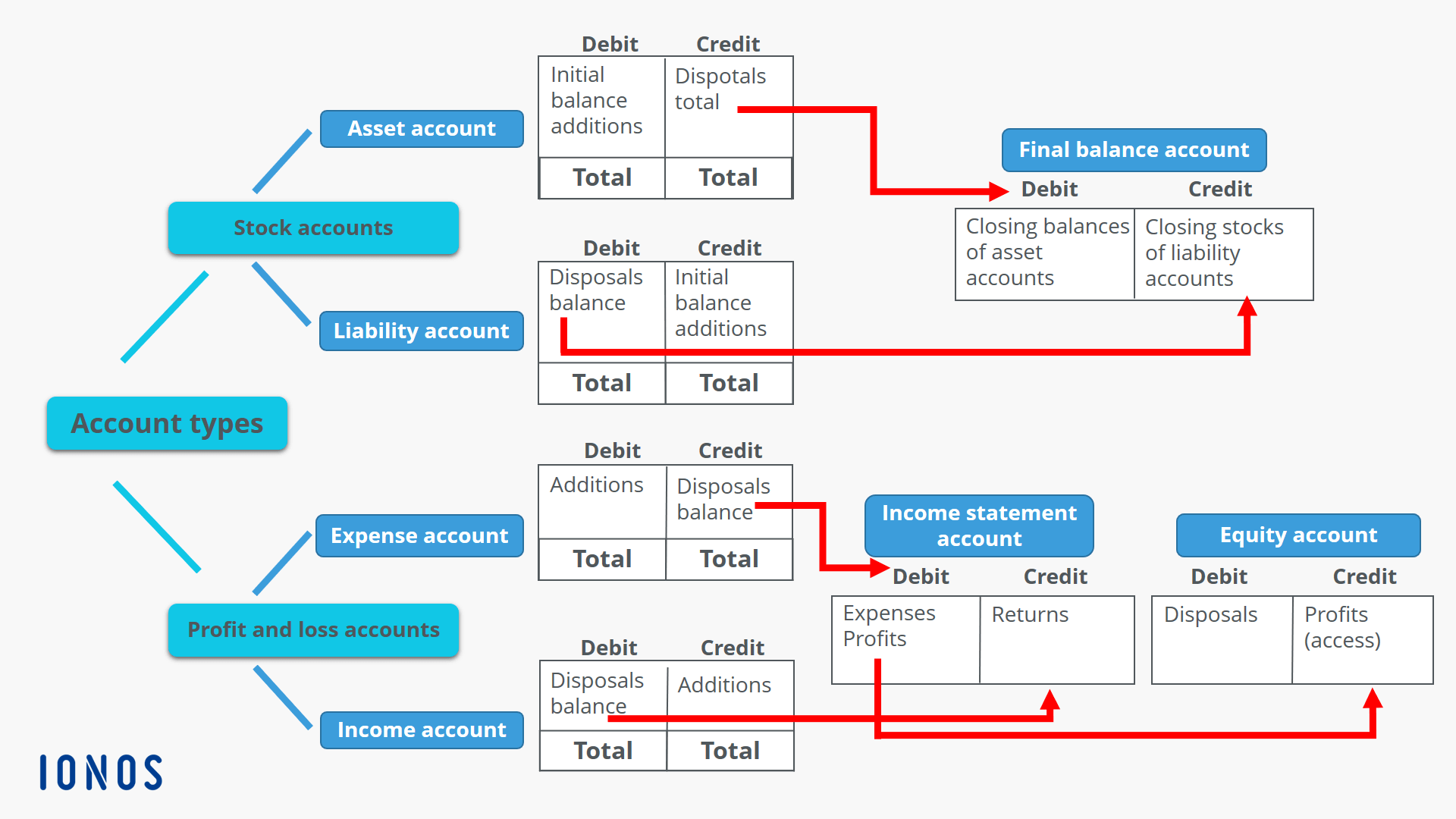

Debits and credits across different account types

This should give you a grid with credits on the left side and debits at the top. However, your friend now has a $1,000 equity stake in your business. You’ve spent $1,000 so you increase your cash account by that amount. At FreshBooks, we help you protect your profits and time with a powerful bookkeeping service. By integrating with Bench, we help you track every dollar you spend while Bench handles bookkeeping and tax preparation.

Perpetual vs Periodic Inventory System Journal Entries

For example, if you stock up on new inventory, more resources are coming into your company. Assets accounts track valuable resources your company owns, such as cash, accounts receivable, inventory, and property. Sage Intacct can automate debits, credits, and the entire AP workflow to make financial management faster, more efficient, and more accurate.

An asset or expense account is increased with a debit entry, with some exceptions. When you sell the $100 product for cash, you would record a bookkeeping entry for a cash transaction and credit the sales revenue account for the sale. This transaction transfers the $100 from expenses to revenue, which finishes the inventory bookkeeping process for the item. Debits are typically used to decrease revenue accounts, although this is rare and often related to returns or customer allowances. Conversely, a revenue account is increased by credits indicating activities that boost revenue, such as sales of products or services.

- He is the sole author of all the materials on AccountingCoach.com.

- The journal entry includes the date, accounts, dollar amounts, and debit and credit entries.

- Debits increase asset and expense accounts while decreasing liability, revenue, and equity accounts.

- When the work is completed, the $100 is debited to the finished goods inventory account.

- Record sales in the sales operating account with the appropriate sales object code.

- Conversely, a revenue account is increased by credits indicating activities that boost revenue, such as sales of products or services.

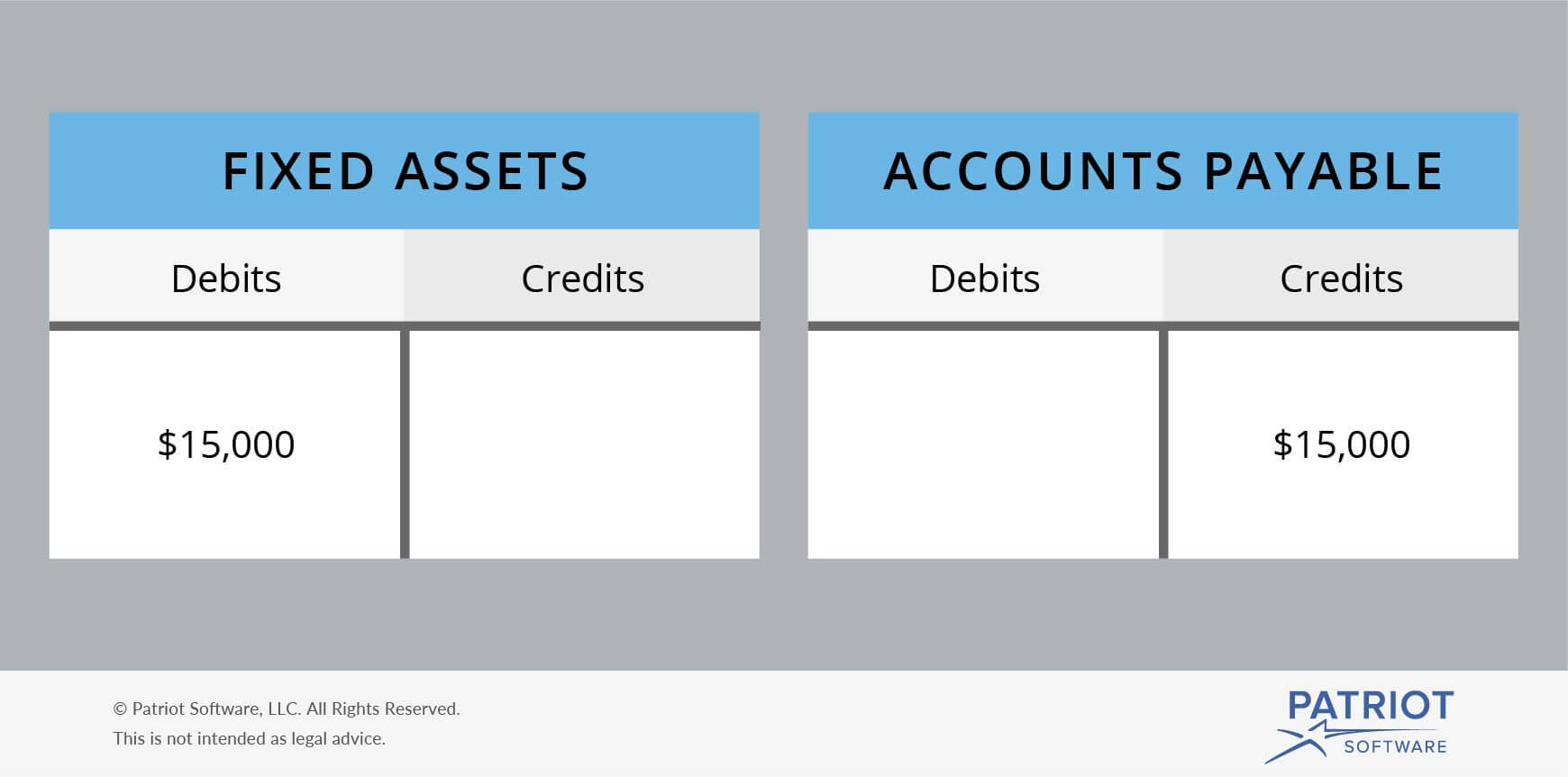

For example, if a business takes out a loan to buy new equipment, the firm would enter a debit in its equipment account because it now owns a new asset. Transactions 1 through 3 are for purchases under the perpetual inventory system. With the right tools and a clear understanding of debits and credits, you can improve your financial reporting and set your business up for long-term success. The company receives equipment (asset increases) but decreases its cash (asset decreases). Here’s a rundown of how debits and credits affect various accounts. Debits and credits tend to come up during the closing periods of a real estate transaction.

This method concludes that the stock first purchased for inventory is also the first to be sold, even if it’s physically not. All businesses must report their inventory to their country’s revenue collection agency. However, one potential downside of using credits is that they can make it more difficult to determine the true cost of goods sold (COGS). This is because each credit increases the value of your inventory without necessarily reflecting an actual increase in sales revenue. Determining whether inventory is a credit or debit in your business can be confusing, but it’s essential to get it right.

This will show income (credit – C) to the operating account and an expense (debit – D) to the customer’s account that is receiving the inventory. This depends on the area of the balance sheet you’re working from. For example, debit increases the balance of the asset side of the balance inventory debit or credit sheet. There is also a difference in how they show up in your books and financial statements. Credit balances go to the right of a journal entry, with debit balances going to the left. The difference between debits and credits lies in how they affect your various business accounts.

Leave a Reply